Fern: We recently got the 2023 assessment for our house.

Joe: We did? Uh-oh!

Fern: Everybody got a new assessment. I think the whole state. And the housing assessments went up. Way up.

Joe: The guys in my Wednesday morning coffee group were talking about their assessments. What do you call “way up”?

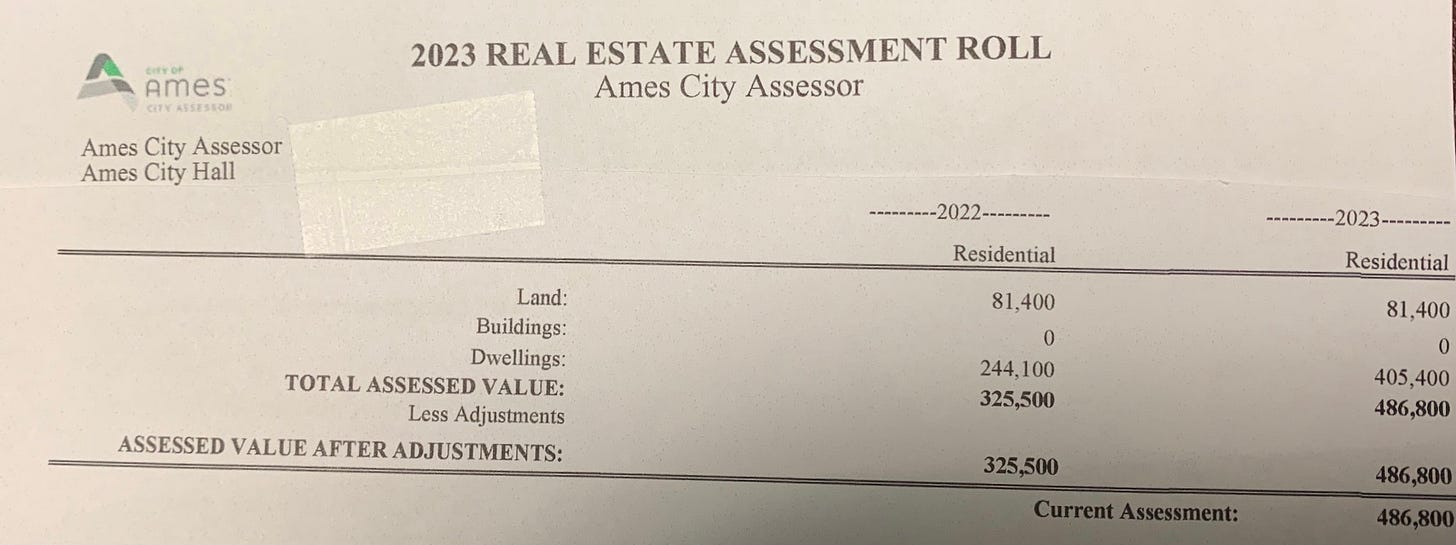

Fern: Our house assessment in 2022 was for a dwelling that was $325,500. The new assessment for 2023 is $486,800. A difference of $161, 300. That’s a percentage of . . . Gee, a lot. If I could remember how to do the math, I’d tell you. I used to know how to compute percentages in 5th grade.

Joe: That’s 49.5%! It went up half its value in one year? That seems like a huge difference.

Fern: How’d you come up with the percentage so fast?

Joe: I googled it. But I’m not sure what it means. You know that is not my area of expertise. One of the coffee guys used to be a county assessor and he tried explaining something called “millage” to me.

Fern: And?

Joe: And I looked serious and nodded my head, hopefully in the right places. I don’t think I fooled him, but he was too kind to say so. Look, I know how to cook and fix things. I have faith that you’ll take care of the finances, even if you don’t know percentages. I’m assuming we have enough.

Fern: The assessment is related to how much you should be able to ask when you sell your home. It appears that our house, a tastefully remodeled 1950’s ranch of modest proportion, can sell for something close to half a million dollars. We paid $285,000 for it twelve years ago. So if we list the house today, we should be able to ask about $480,000. Maybe more. As my father used to day: Rich or poor, it’s good to have money.

Joe: Should we be sharing this information in a column?

Fern: I don’t know why not. Do you think someone’s going to read this and make us an offer? Anyway, housing assessments are public knowledge. Anyone can look it up. I looked up all of our neighbor’s assessments. It’s interesting. We’re not even the highest rise of assessment in the neighborhood.

Joe: This is what grownups talk about. This, and sports.

Fern: Sports are one reason people want to live in our neighborhood. My friend Brenda who sells real estate says that we own a lake house. Except our lake is the football stadium.

Joe: There are only – what seven or eight home games a year? And our house is assessed so much because of walking access to a sports complex?

Fern: Location, location, location.

Joe: If you’ve got the money, what’s so terrible about paying taxes? Republicans – and often rich ones -- talk about lowering taxes. That’s a big thing with them. But why isn’t paying taxes seen as a patriotic thing to do? Taxes help pay for the public good.

Fern: I agree. We want well-maintained roads, a fire and police department to protect us. Good schools. Schools are often lousy in poor neighborhoods because . . . well, the tax base doesn’t support the school. Remember when a retired friend from Arizona came to visit? He said that where he lived, if a retirement community was not within a certain number of miles of a school, the home-owners didn’t have to pay any school taxes. As a public-spirited Iowan, he thought that was odd, but supposed that some older people saw it as a plus. I see it as a way to have other people’s children go to underfunded schools. It’s selfish.

Joe: I’m not against a little selfishness. Capitalism involves a measure of selfishness. And so does good mental health, frankly. The problem seems to be that using selfishness to get ahead can morph into a whole lot of greed. I may not understand millage, but I do play poker. It’s my experience that in poker, as in life, it’s not good to let yourself become greedy.

Fern: I’m reading Poverty By America, by Matthew Desmond. He also wrote Eviction. Both books are about being poor in America and how difficult it is to get out of the culture of poverty. He thinks that poverty can be “fixed,” but endures because affluent Americans actually benefit from it. Like homeowners, for example. Who get tax breaks. Which I’m glad we do. But I also don’t think we need an economy that makes it harder for people to get out of a life of deprivation.

Joe: Iowans used to be proud of our public schools.

Fern: Iowa used to have elected officials who cared about public education and didn’t concoct give-aways to religious schools and call it “parental choice.”

Joe: Which means a parent gets to choose . . .

Fern: Except if a woman wants to be a parent in the first place.

I know this is terribly divided country, but I honestly don’t get it. Republicans don’t like to pay taxes. Now they also want to ban books but not assault weapons. There are people in this country who believe that democrats are pedophiles. Well, there are actually Republican representatives who do. One was just on Sixty Minutes last week.

Joe: Back to politics once again. I didn’t really want to write about politics this week. It’s so discouraging.

Fern: You know what? Books. Guns. Education. Home assessments. Your own body. Everything is political.

I love this conversation on every level and I hope it is being duplicated in homes across our state. We also got our property assessments. We honestly do not mind paying taxes and I know that sounds crazy, but we know we are where we are in our life because we attended great public schools. Our schools were seen as a community good. Education was a community good. Offering a hand up to families who struggled was a priority. I know that because after my dad died, we were one of those families for a while after my dad died. It bothers me a great deal that how our tax revenue is spent (or not) these days is being decided by republicans in the legislature who seem to have no notion of what is the greater good for the citizens of Iowa, especially for the children. Their lack of vision leaves me frightened for the future.

A single, childless child man said, “I want good schools because I don’t want to live in a country of stupid people.”

As a senior citizen, I want good schools because well-educated workers pay into the Social Security fund. (That a whole ‘nuther subject!)

Seriously, I want to pay taxes for good schools because it’s the right thing to do. Period. A well-educated citizenry is the basis of democracy.